Heiken Ashi Charts: Identify Trend with Reduced Market Noise

This script plots both real and HA candles regardless or which are used on the chart in TV settings. (and has the functions for you to use.) Lots of people seem to misunderstand backtesting based on HA candles. Backtesting with HA candles leads to impossible trades. That doesn’t mean you might not want to look…

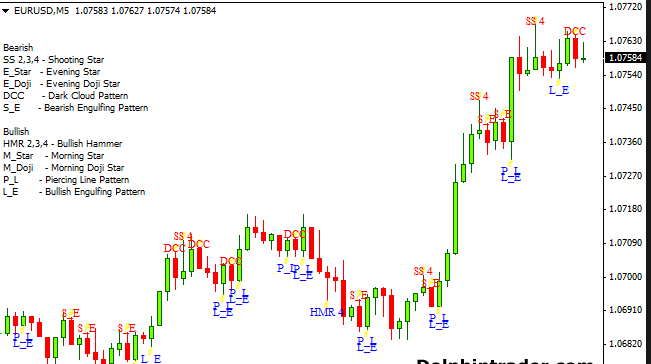

All these were used to get trade confirmation. Trend reversal occurs when the price comes out of the existing trend and starts moving in the opposite direction. The presence of Doji or Stars shows the uncertainty of the trend. It shows the traders are losing confidence in the current trend. The presence of Doji in the Heikin Ashi candlestick pattern indicates of a potential trend reversal is due.

Mutual fund investments are subject to market risks. Please read the scheme information and other related documents carefully before investing. Past performance is not indicative of future returns.

Trading

He will also be sharing how to take entry on Daily Timeframe charts and ride the trend on the monthly timeframe. You can use this script to setup alerts on Heikin-Ashi bar color change. You have to apply this script to usual candles and not Heikin-Ashi!!! On change you’ll see green/red arrows and alert will be fired. Also you can find in the code calculations of all HA OHLC values.

All the open, high, low, and close prices are calculated differently. With the same idea of the VPSA i make the VPSA2 to make Heiken Ashi style synthetic graph of the price and the volume effect, its easy to see the volume trends. Each instrument have a more clear time frame to see the volume patterns. I see very useful like a secondary analysis layer. In the graph show the same RSI with price and VPSA2 like source.

The Heikin-Ashi technique can be used in conjunction with candlestick charts when trading securities to spot market trends and project future prices. But for information on accurate price data points, one should consult the traditional candlestick chart. No gap is found in Heikin Ashi chart patterns.

Due to this smoothening process, the down bars in the uptrend are less prominent than the normal candlesticks. Heikin-Ashi charts are developed by Munehisa Homma, a Japanese trader in the 1700s. They are spelled as Heiken-Ashi, which means “average bar” in Japanese.

- In this chart, there are a few things added to the Heikin Ashi chart.

- And, the other side of the candles does not have tails.

- Those levels are then run through the Heiken-Ashi Candle formula to create a new hybrid candle on the chart.

- It can be used as a stop-loss or support/resistance indicator.

- Also from the colors of the candles, we can identify the bullishness or bearishness of the price trend.

The current bar’s low, the current https://1investing.in/ open, and the current Heiken Ashi close is used to calculate the low. The greatest of the current bar’s high, the current Heiken Ashi open, and the current Heiken Ashi close is high. To calculate the next close, use the open, high, low, and close from that period.

Download Heiken Ashi indicator

And, the other side of the candles does not have tails. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website.

What is the Heikin Ashi Chart?

This is a Japanese word which means “Average Speed”. Therefore the pattern reflects the average status of the market speed. So, you can refer to this pattern as a modified candlestick chart pattern.

Most interesting aspect of Heikin-Ashi trading is trailing stop loss to low of previous candle. • Long down candles with little upper shadow represent strong selling pressure. These charts are easily capable to adopt other technical indicators. Therefore it is easy to get stronger market signals. There is a multiple exit advantage with this strategy. Or if stochastic reaches the oversold zone, i.e. the stochastic goes near or below 15.

Trending news

The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. If the number of candles is not enough, then choose a greater depth of history, for example 1 year or 5 years.

Opening Range is very often a measure of security high and low generally monitored by breakout traders to gauge the sentiment of the market…. Kindly make sure you read the account opening documents as prescribed by SEBI. Secure your account from unauthorized transactions by updating your mobile numbers/email IDs. Receive information directly from the Exchange on your mobile/email at the end of the day.

Heiken Ashi: The Trend Trading System

At Elearnmarkets, all our trainers are highly qualified and experts in their particular field. The recordings of the webinars you have joined till date will be available in the ‘My Webinars’ section. Yes, the recording of the webinar will be available within 24 hours from the completion of the live session.

What if you can use a vwap on something longer than a daily chart? What if you wanted to have both Heiken Ashi candles and Japanese candles on your same chart without… I originally wrote this script earlier this year for my own use. This released version is an updated version of my original idea based on more recent script ideas. As always with my Alert scripts please do not trade the CALL/PUT indicators blindly, always analyse each position carefully. Always test indicator in DEMO mode first to see if it profitable for your…

Or if the Heikin Ashi candle goes below the SMA line, even if it is green, the trader can consider exiting from the position. There is an inherent fallacy in the logic of the calculation of Heiken Ashi candlesticks. When the opening price of a Heikin Ashi candlestick is calculated, we calculate the opening and closing price of the previous bar. But it sounds like that logic – Which came first, the hen or egg? HAMA (Heiken-Ashi Moving Average) Candles are built using different moving average lengths for the open, high, low, and close. Those levels are then run through the Heiken-Ashi Candle formula to create a new hybrid candle on the chart.

As we have discussed already, the Total Return Swap charts are a little different from traditional candlestick charts. Therefore, we need to interpret the candlestick patterns differently. The absence of shadows on candlesticks is a significant indicator that a big bullish trend is about to begin. This method is one of the best Heiken-Ashi strategies because of its track record and high success rate.

It just shows us in what direction the trend was. The strong bullish or bearish trend is the most prevalent Heikin-Ashi approach, which aims to detect the start of a significant uptrend or negative one. If a favourable trend starts, traders with short positions should exit, while those with long positions should increase and consolidate their positions. Traders can use the trading strategy to figure out when to hold on to a transaction, when to stop trading, and when a reversal is coming. As a result, traders may have to modify their positions.

• One can use multiple ways to book profits and exit, like stochastic near 15 or green candle or prices above 20 DMA. Most interesting aspect of Heikin-Ashi trading is trailing stop loss to high of previous candle. Understanding underlying formula used for the construction of Heikin-Ashi candlestick charts helps traders to take prudent decisions, while trading complex scenarios. An easy way to learn everything about stocks, investments, and trading.

The Heikin Ashi Trend Indicator used to determine the price direction of an asset, as well as draw attention to when the price direction is changing. The HAT indicator translates the current close/open/high/low into Heikin Ashi and smooths them a bit using Tilson T3 formula. Introducing HARSI – the RSI based Heikin Ashi candle oscillator. This is Heikin Ashi candles in an oscillator format derived from RSI calculations, aimed at smoothing out some of the inherent noise seen with standard RSI indicators.

How do you use Heiken Ashi indicator?

In HA we just trade with the color. Here, the theory is quite simple, the red candle indicates the market is going down while green shows the uptrend in the market. So accordingly we can take a position.

The longer the run of candlesticks without tails, the greater the expected trend. Traders could also expect a new stable downward negative trend to continue if they find candlesticks with no upper shadows. Heikin Ashi candlesticks appear a little different from normal candlesticks. Heiken Ashi uses previous period price action and combines them with current price action to come up with smoother candles. This is why we find the Heiken Ashi candlesticks are comparatively smoother and less volatile.

We do not get any idea of previous price actions or trend direction. The traditional candlestick charts consist of four price components, Open, High, Low, Close or OHLC. Also from the colors of the candles, we can identify the bullishness or bearishness of the price trend.